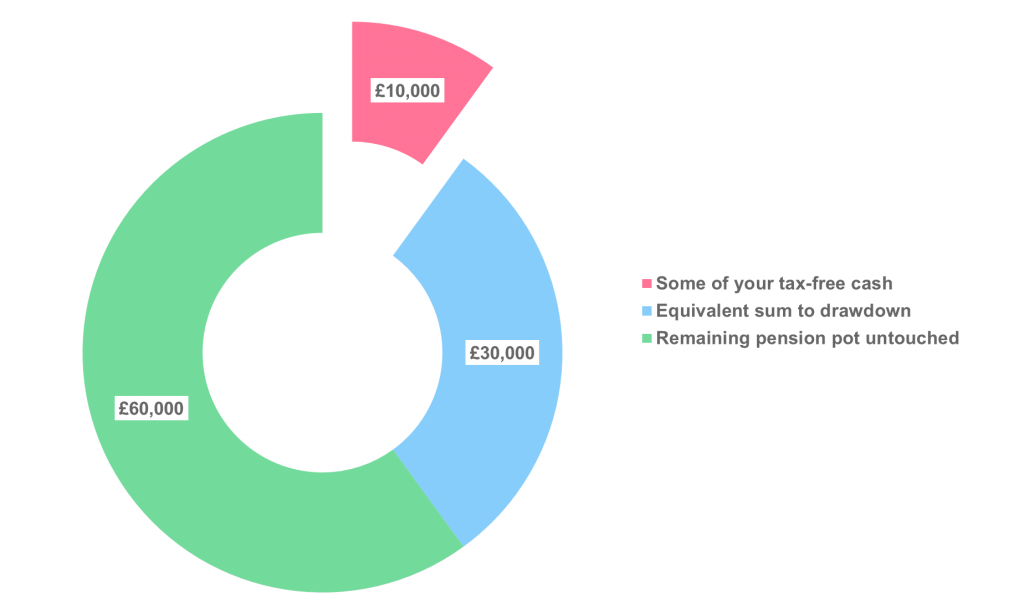

If you’re looking for a wider choice of investments in a SIPP, such as fund management, or stocks and shares, you’ll need to consider firms such as Hargreaves Lansdown* and Fidelity. Some of the very cheapest SIPPs, such as Vanguard’s, will only let you invest in their range of funds. To decide which one is right for you, you first need to decide how much choice you want in terms of your investment options. If you’re ready to open a SIPP, you need to find the right investment platform. Our Pensions Guide explains the rules in full. If you don’t have any earnings, you can still make SIPP contributions of up to £2,880 a year and receive basic-rate tax relief, giving you a total of £3,600. So if £10,000 was paid into your workplace scheme in the current tax year, you’d only be able to contribute up to £30,000 when opening a SIPP. These rules apply to all personal and workplace pensions. However, if you earn £200,000 a year or more, the limit to invest into a pension – known as the “annual allowance” – gradually falls, until it is just £10,000 a year.

You can pay in 100% of your earnings up to a limit of £60,000 into a SIPP each tax year. How much can be paid into a SIPP each year?

If you are wanting to know more about getting financial advice, how much it costs and if it might be right for you, check out our article. If you do choose to open a SIPP, consider taking financial advice to help you select and monitor your investments and the investment platform’s charging structure, unless you’re a confident investor. Make sure any financial adviser you speak to is regulated by the Financial Conduct Authority. It’s easier to keep track of all your pension funds in one place – and also gives you greater control over where your money is invested. Why invest in a SIPP?Īs well as giving you control over where your pension is invested, opening a SIPP can also be a useful way of bringing together different pensions that you’ve accumulated with different employers over the years. If you prefer to have less choice and have someone build a balanced portfolio for you, a ready-made personal pension may be a better option for you.įull info on how pensions work can be found in our pensions guide. You may also find that it’s worth transferring an existing pension, such as an old workplace pension scheme, into a SIPP, if the fees are lower and the investment platforms range broader.

#Best funds for income drawdown full

But if you’re self-employed – or you’ve got lots of different pensions that you’d like to combine into one pension pot – a self-invested personal pension (SIPP) may be a good option for you, whether that is a full or low-cost SIPP. The easiest way to set up a pension is usually through your employer.

#Best funds for income drawdown how to

This guide explains what a SIPP is, how to choose the right one and lists our top picks. If you want to pick your own investments for your pension, a self-invested personal pension (SIPP) could be right for you.

0 kommentar(er)

0 kommentar(er)